1099 hourly rate calculator

Enter your info to see your take home pay. Here is how to calculate your quarterly taxes.

Payroll Tax Calculator For Employers Gusto

So typically a freelance rate is 3x what a current hourly rate may be as a general guide.

. See where that hard-earned money goes - Federal Income Tax Social Security and. Ad Payroll So Easy You Can Set It Up Run It Yourself. This is a great exercise to come up with a.

See how your refund take-home pay or tax due are affected by withholding amount. Many contractors will outline. Let us help you figure that out.

Calculate your adjusted gross income from self-employment for the year. Federal income tax rates range from. Adjusting- 91hr08 114hr on 1099.

We have put together a calculator you can use here to calculate your personal hourly rate. Base Salary year. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Use this calculator to view the numbers side by side and compare your take home income. Use the IRSs Form 1040-ES as a worksheet to determine your. Just enter in a few.

Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor. Electricity water equipment supplies etc - because.

For example a W-2 employee with no. In the simplest case you can simply addsubtract 765 half of the total FICA taxes as an easy 1099 vs W2 pay difference calculator for hourly rate. Use this Self-Employment Tax Calculator to estimate your.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Self-employed workers are taxed at 153 of the net profit. For example how does an annual salary as an employee translate to an hourly rate as a contractor.

How to calculate the hourly rate differences between W-2 and 1099 workers You may pay contractors a set amount either hourly or by the project. If you are not interested in covering overhead - eg. The rule of thumb for conversion from a full-time salaried position with benefits to an hourly rate as a contractor or freelancer is annual salary 2000 X 2 3 or 4 Your target.

Use this tool to. How It Works. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

This percentage is a combination of Social Security and Medicare tax. As a 1099 contractor you have higher FICA taxes that total 153 765 more than W-2 but you also have access to deductions W-2 employees do not such as the health insurance deduction. The maximum an employee will pay in 2022 is 911400.

1099 vs W2 Income Breakeven Calculator. Taxes Paid Filed - 100 Guarantee. Estimate your federal income tax withholding.

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Taxes Calc Discount 58 Off Www Ingeniovirtual Com

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

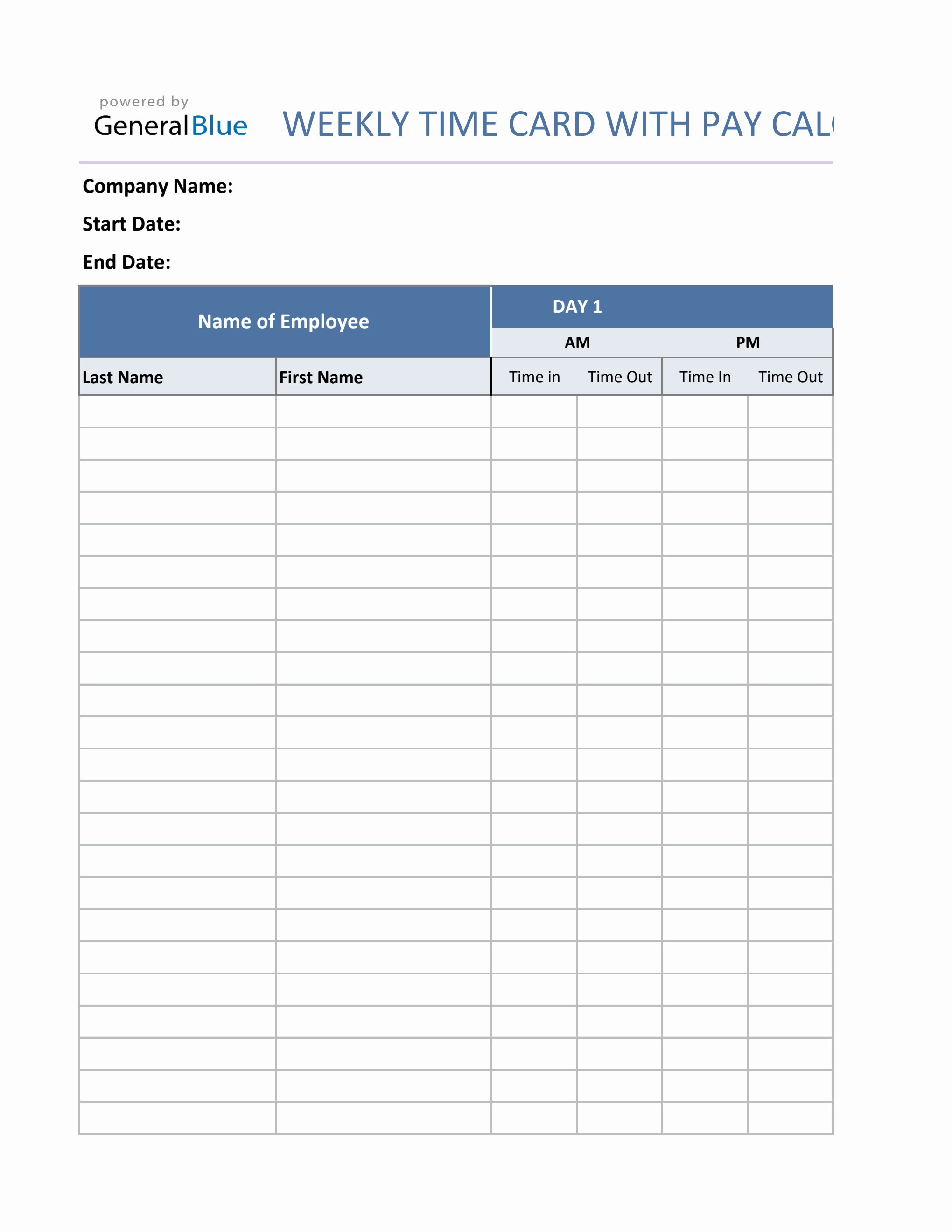

Weekly Timecard With Pay Calculation For Contractors In Excel

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Taxes Calc Hotsell 58 Off Www Ingeniovirtual Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Professional Templates Business Template

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

How To Calculate Fte For The Ppp Bench Accounting

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Interest On Home Equity Loans Is Still Deductible But With A Big Caveat Published 2018 Home Equity Loan Home Equity Home Improvement Loans

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

How To Calculate Your 1099 Hourly Rate No Matter What You Do

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

.png)

1099 Taxes Calculator Estimate Your Self Employment Taxes

Free Employer Payroll Calculator And 2022 Tax Rates Onpay